Electric Vehicle Tax Exemption 2025 - Ev owners have been exempt from paying road tax since 2025 and will continue to enjoy this privilege until december 31, 2025. Duty exemptions for electric vehicles extended until end of 2025 New, Under section 80eeb, eligible individuals can claim a deduction on the interest paid on loans taken to purchase electric vehicles. From 1 july 2025 employers do not pay fringe benefits tax on eligible electric cars and associated car.

Ev owners have been exempt from paying road tax since 2025 and will continue to enjoy this privilege until december 31, 2025.

What to know about 2025 changes to the electric vehicle tax credit, You get a deduction of rs. This initiative incentivizes individuals by.

You get a deduction of rs. Eligibility criteria for section 80eeb for getting tax benefits on ev.

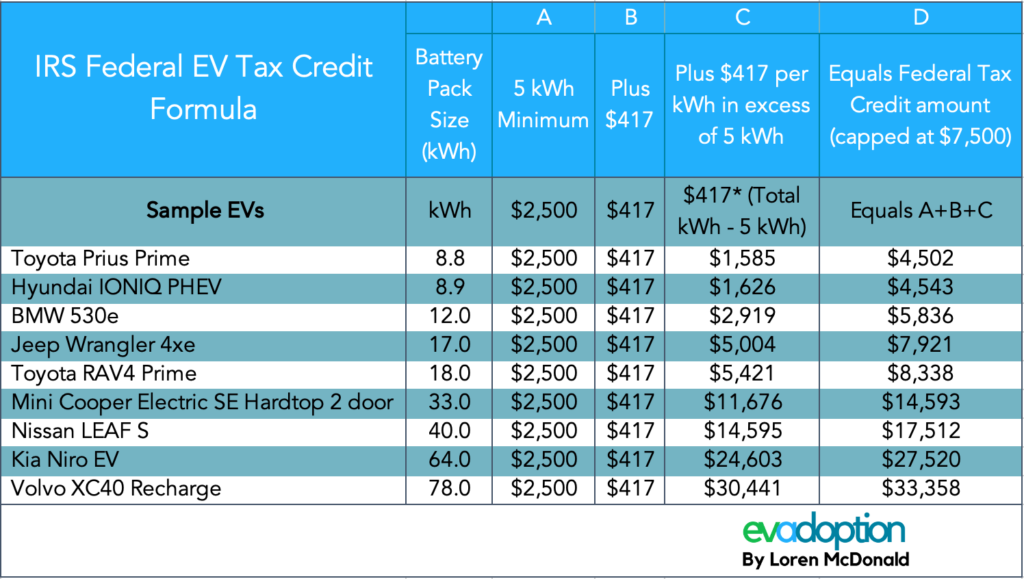

People who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000.

A comprehensive guide to the 2025 electric vehicle tax credit Facet, From 1 july 2025 employers do not pay fringe benefits tax on eligible electric cars and associated car. Jul 08, 2025 11:20 am ist.

Tax implications of electric vehicles and home charging.

Electric Vehicle Tax Exemption 2025. This initiative incentivizes individuals by. Jul 08, 2025 11:20 am ist.

Get Ready for an Instant Electric Vehicle Tax Credit in 2025, This initiative incentivizes individuals by. You get a deduction of rs.

Boston College Football Schedule 2025-25. “i would say yes,” armstrong. The acc completed their release […]

Switzerland to end electric vehicle tax exemption in 2025, From 1 april 2025, drivers of electric and low emission cars, vans and motorcycles will need to pay vehicle tax in the same way as drivers of internal. Tax incentives for electric cars.

Electric Vehicle Tax Exemption 2025 Lorne Rebecka, Most states in india offer complete or partial road tax exemption for electric vehicles. Finance minister nirmala sitharaman is likely to present union budget 2025 this month.